Brazilian sugar exports via containers experienced a rebound in 2023 after two years of decline, which had been attributed in part to the “containergeddon” movement. This resurgence in shipments coincided with a period of high sugar production in the country and a decrease in seafreight rates. Additionally, challenges faced by other major global sugar producers contributed to Brazil’s dominance in the market.

India, for instance, encountered difficulties with its harvests and showed reluctance in returning to sugar exports, especially with its focus on ethanol production. Consequently, Brazil emerged as a key player in the market. Despite the preference of national producers for bulk shipping methods, container shipments accounted for a notable portion of exports, involving intricate negotiations and higher value-added transactions.

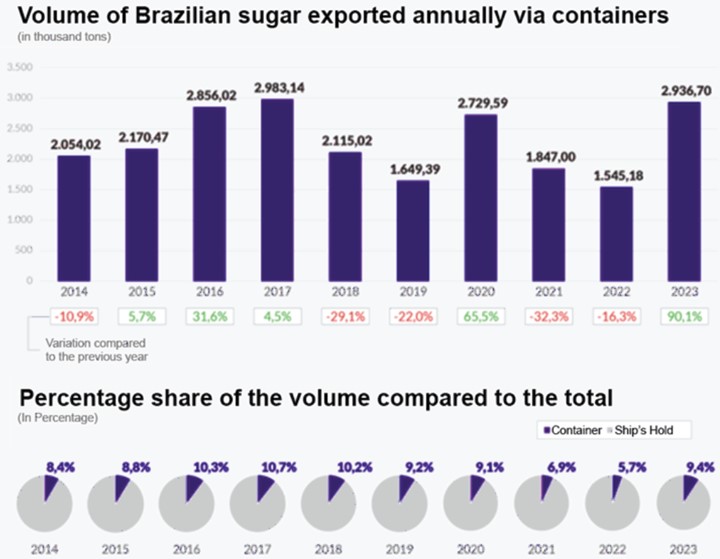

According to maritime agency Williams, Brazil exported 2.94 million tons of sugar via containers in 2023, representing 9.4% of the total exported to other countries. This marked a significant 90.1% increase compared to previous years, nearing the record high witnessed in 2017 when 2.98 million tons were exported via containers, constituting 10.7% of the total shipments.

In 2023, the freight rates saw a favorable trend, returning to pre-pandemic levels, which could explain the rise in exports. However, the outlook for this year isn’t as promising, with prices doubling in January due to tensions in the Middle East.

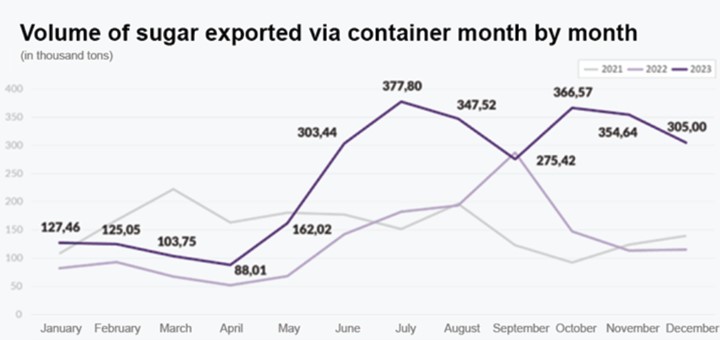

Throughout most of the year, monthly export volumes exceeded those of 2022, except for September, when 275.42 thousand tons were exported; the previous year, September marked the peak of sugar shipments, with 287.35 thousand tons.

In 2023, the highest volume of shipments was recorded in July, totaling 377.8 thousand tons, while April witnessed the lowest volume at 88.01 thousand tons.

Top Importers

In 2023, over 1,160 companies engaged in sugar imports via containers, marking a significant 48.3% increase from the 785 comp –

– anies in the preceding year. Among these, the 15 largest importers of Brazilian sugar in this category were identified.

The leading importer was Blu Logistics, acquiring 73.76 thousand tons, despite not recording any purchases the previous year. Following closely was MMK, with 63.73 thousand tons, representing a remarkable annual increase of 130.5%. Omar International secured the third position, importing 57.45 thousand tons, so showing no imports in 2022.

The composition of companies involved in trading Brazilian sugar differed significantly between those utilizing container shipments and those relying on ship holds in 2023. Out of nine companies engaging in both methods, Louis Dreyfus emerged as the top mover in terms of container shipments, handling 42.07 thousand tons, alongside 2.65 million tons transported via ship holds.

Sucden followed closely, moving 15.51 thousand tons via containers and 3.23 million tons via ship holds. Other companies featured on both lists include Alvean (2.51 thousand tons), Cofco (5.42 thousand tons), Sugar (1.28 thousand tons), Agrocorp (1.22 thousand tons), Ed & F Man (695 tons), Czarnikow (693 tons), and CSC (475 tons).

Highlighted Ports

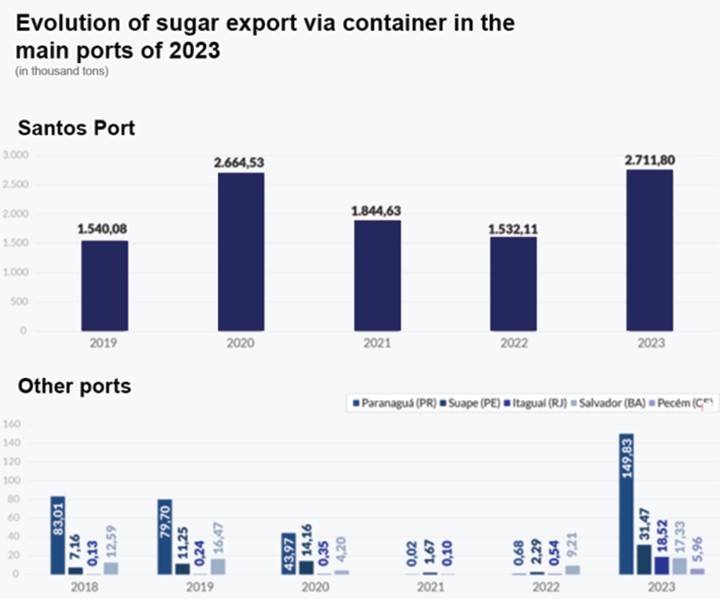

Despite retaining a significant portion of shipments, accounting for 99.2% of the total seen in 2022, the port of Santos (SP) experienced a decrease in its market share last year, dropping to 92.3% or 2.71 million tons. However, this volume represents a notable 77% increase compared to the 1.53 million tons shipped in 2022.

On the other hand, Paranaguá (PR) saw a remarkable surge, handling 149.83 thousand tons, which constituted 5.1% of the total. This marks a substantial increase from the mere 679.1 tons transported in the previous year. Following closely, the port of Suape (PE) secured the third position, handling 31.47 thousand tons.

Furthermore, several other ports reported sugar exports via containers in 2023. These include Itaguaí (RJ) with 18.52 thousand tons, Salvador (BA) with 17.33 thousand tons, Pecém (CE) with 5.96 thousand tons, Navegantes (SC) with 1.64 thousand tons, and Itapoá (SC) with 144.95 tons.

Main destinations

With the substantial volume exported this year, Brazilian sugar reached every continent. Similar to 2022, the majority of shipments were directed to Africa, totaling 1.76 million tons, which accounts for 59.9% of the total exports. This figure represents a significant 48.5% increase compared to the previous year.

In terms of individual countries, Africa stands out prominently, with 16 of its nations featuring among the top 20 destinations. Remarkably, four out of the top five destinations are African countries: Guinea (219.09 thousand tons), Cameroon (189.41 thousand tons), Mauritania (165.88 thousand tons), and Togo (163.98 thousand tons).

Destinations of Sugar | ||||

Exported via containers (2023) | ||||

By Continent | ||||

In Thousand Tons | % | |||

1 | Africa | 175972 | 59.90 | |

2 | Asia | 54051 | 18.40 | |

3 | South America | 26539 | 9.00 | |

4 | North America | 22479 | 7.70 | |

5 | Europe | 9156 | 3.10 | |

6 | Central America | 2830 | 1.00 | |

7 | Oceana | 2642 | 0.90 | |

Asia emerges as the next significant destination, having received 540.51 thousand tons, equivalent to 18.4% of the total shipments. The continent witnessed a remarkable threefold increase in demand for Brazilian sugar compared to 2022 when it received 179.31 thousand tons. Notably, Yemen stood out in 2023, receiving 245.03 thousand tons and becoming the primary destination for Brazilian sugar.

South America ranks third this year as a major buyer of sugar, importing 265.39 thousand tons. This marks a substantial increase from the mere 2.87 thousand tons received in 2022.

Conversely, Europe experienced a 12.5% decrease in Brazilian sugar imports, totaling 91.56 thousand tons, resulting in a drop to fifth place among continents.

Overall, Brazilian sugar exported via containers reached 100 countries in 2023, a notable increase from 88 in the previous year and 90 in 2021.

Since the inception of the historical data series in 2012, the average annual variance between the volumes recorded by the two entities is 238.53 thousand tons. The most significant deviation occurred in 2016, with Secex’s figures surpassing those of Williams by 1.16 million tons. Conversely, in 2023, the variance was 51.98 thousand tons, marking the smallest difference in the past twelve years.

References

NovaCana – Published: 15 Mar 2024 – 10:33 | Updated: 15 Mar 2024 – 11:24 (https://www.novacana.com/data/planilha/exportacao-brasileira-de-acucar-via-conteiner/)

2 Comments

am interested in getting sugar business partnership in brazil

Dear Kolum, Thank you for your interest in our products. Kindly email your LOI to support@sales.imexbz.com and promptly we shall get back to you. Wishing you a wonderful day. IMEX BZ LLC